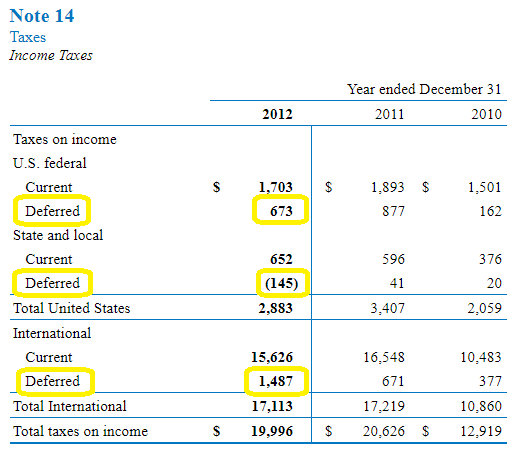

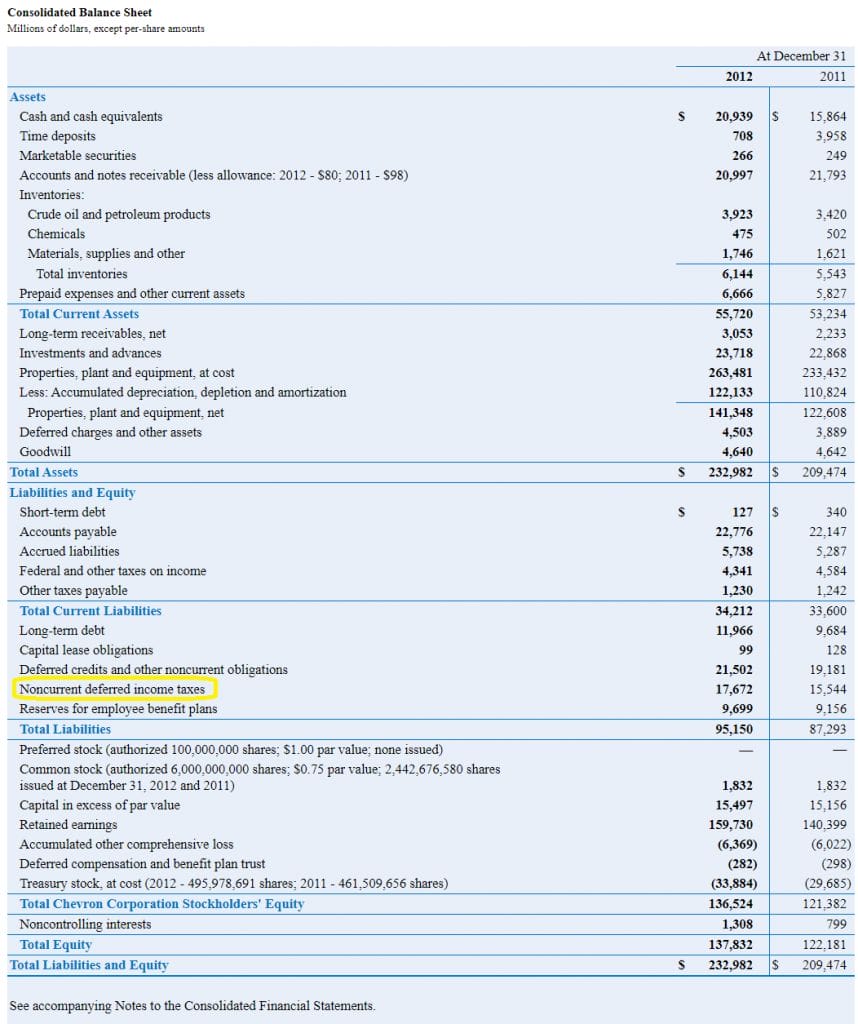

IAS 12 Para 81(g)(i)(ii), analysis of deferred tax in balance sheet and income statement by category, current tax reconciliation – Accounts examples

IAS 12 paras 81(c), 81(g) tax reconciliation and deferred tax balances with detailed explanatory notes – Accounts examples

:max_bytes(150000):strip_icc()/deferredincometax-v3-b8dc55e780ab4f47a0987161ece97060.png)